Humanoid Robots: Understanding the Risks and Limitations in 2025

Humanoid robots are rapidly evolving in form and function. But alongside the benefits come risks and limitations we must not ignore.

Where Are Humanoid Robots Being Used Today?

Humanoid robots are now working in hospitals, shopping malls, and schools. They mimic human gestures and interact with people directly.

For example, Japan and South Korea have embraced humanoids in retail and elderly care. Their use in artificial intelligence development highlights growing demand.

Top Physical Safety Risks Posed by Humanoid Robots

Despite sophisticated sensors, humanoid robots have caused physical injuries in real-world situations.

| Risk Type | Details |

|---|---|

| Sensor Failure | Fails to detect gestures, objects, or people in its environment. |

| Force Miscalculation | Applies too much pressure, risking physical harm to humans. |

| Movement Delay | Slow or improper response to dynamic changes in surroundings. |

In Russia, a chess-playing robot broke a boy’s finger during a match. This raised concerns over mechanical safety and AI judgment.

Sensor failures and poor real-time adaptation increase risks, especially in public spaces or fast-moving environments.

A detailed breakdown of known risks is shown below:

Cases like these have triggered calls for stricter robot safety standards globally.

Can Humanoid Robots Violate Our Privacy?

Most humanoid robots include cameras, microphones, and data-sharing protocols. This raises surveillance and consent issues.

In healthcare, robots like Grace gather patient feedback. But without strong regulation, sensitive data could be misused.

Privacy laws such as GDPR in Europe and HIPAA in the U.S. attempt to regulate usage, but enforcement remains difficult.

Real-World Case Study: Sophia’s Public Debut and Impact

Sophia, developed by Hanson Robotics, became a global icon after being granted citizenship in Saudi Arabia in 2017.

Her facial expressions, speech, and interviews gave the illusion of consciousness, though her responses were pre-programmed.

This drew criticism from AI experts, who argued that the media overstated her abilities.

Despite her fame, Sophia lacks genuine reasoning—a limitation shared by many human-like robots.

Emotional Limitations in AI-Humanoid Communication

Humanoid robots can mimic human emotions but can’t experience them. This often leads to shallow or awkward interactions.

In caregiving roles, especially with people older than 70, this limitation creates emotional disconnect and may even increase loneliness.

For instance, Grace—built to assist in eldercare—can smile and speak, but lacks empathy and moral understanding.

Studies show that overreliance on robotic companionship can reduce meaningful human contact.

Psychological Effects on Children and Older People

A Nature study in 2021 found that children formed emotional bonds with robots, changing their behavior and expectations.

Extended exposure can confuse social norms, especially for children who view robots as friends.

Research from Nature confirms that human-like machines can distort emotional development.

The risk of using humanoids as companions in therapy or teaching must be carefully weighed.

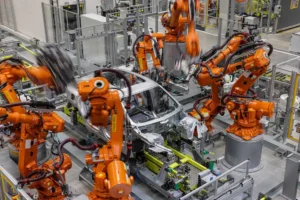

Humanoid Robots Could Threaten the Job Market

Humanoid automation is replacing humans in roles like customer support, hotel reception, and basic teaching.

These robots work 24/7, need no breaks, and provide consistent service. They appeal to businesses aiming to cut costs.

Here’s a quick look at roles being impacted:

Experts warn that automation must be balanced with job creation in human-centric sectors.

Mechanical Limitations of Humanoid Robotics

Humanoid robots still struggle with fine motor skills. Tasks like folding laundry or handling soft objects remain difficult.

Even Boston Dynamics’ Atlas, praised for agility, requires flat terrain and power-intensive support systems.

Battery life is another problem. Most humanoid robots operate under an hour without external power.

Efforts to improve durability and adaptability are discussed often under tech innovation news.

High Development Costs Make Scaling Difficult

Building a single humanoid robot can cost millions. This limits access to wealthy institutions and governments.

These high costs slow down widespread adoption in small businesses or developing countries.

Ethical Dilemmas with Autonomous Humanoids

Should humanoid robots be granted rights? Can they be held accountable for mistakes?

As robots look and act more human, ethical questions multiply.

In education, humanoids teaching students may spread misinformation. In policing, AI judgment could lead to bias.

Experts at Pew Research say regulation must grow with technology to address these gaps.

AI Errors Can Endanger Lives

Humanoid robots rely on AI models to function. Errors in these models can cause accidents or misinformation.

For example, facial recognition flaws have led to wrongful accusations and discrimination.

If used in legal or health decisions, a minor AI mistake could lead to fatal outcomes.

This is why strong ethical frameworks and testing are essential in deploying ethical AI systems.

Infographic: Human Tasks vs. Humanoid Capabilities

Here’s a visual comparison between human strengths and robot limitations:

Source: World Economic Forum

Global Regulation Remains Inconsistent

Different countries regulate AI differently. The European Union leads with its 2024 AI Act for transparency and responsibility.

Meanwhile, the U.S. and China still rely on fragmented laws, leaving gaps in robot deployment policies.

EU’s AI Act aims to standardize risk categories and enforcement tools.

A global approach is needed for harmony in humanoid deployment.

Can Robots Replace Human Connection?

While humanoid robots can perform tasks, they cannot replace empathy, care, and instinctive understanding.

Machines may assist doctors or educators, but human roles remain essential in social and emotional scenarios.

As seen with Grace and Sophia, robotic limitations outweigh benefits in sensitive tasks like therapy or mentorship.

These machines should complement—not replace—human professionals.

Conclusion: Balancing Innovation with Caution

Humanoid robots are changing industries—but they also bring real safety, ethical, and economic risks.

From privacy invasion to AI model errors, their limitations must guide how we build and deploy them.

Transparent regulation, inclusive design, and responsible innovation will shape the safe future of humanoid AI.

Humanoid Robots Risks and Limitations – FAQs

Humanoid robots raise questions about real-world safety and ethical responsibility. Their role in society is expanding rapidly.

However, users, regulators, and designers must address key concerns tied to automation, trust, and decision-making.

The following questions cover the most common concerns about how these robots affect people and industries.

1. Can humanoid robots physically harm people?

Yes. Accidents can happen if sensors fail or movements are poorly calibrated, especially around people older than 70.

2. What industries are most impacted by robots?

Manufacturing, logistics, and customer service are being rapidly transformed by robot integration and automation.

3. Are there privacy risks linked to humanoid robots?

Yes. Data collected through cameras and microphones may raise privacy issues if not properly managed or encrypted.

4. Do humanoid robots replace human jobs?

In repetitive or dangerous roles, yes. But they also create new opportunities in robotics maintenance and AI oversight.

5. How reliable are humanoid robots today?

Most are reliable in controlled environments but can struggle in dynamic or unpredictable real-world conditions.

6. Are they emotionally intelligent?

Not truly. While they simulate empathy using programmed responses, they don’t experience emotions or understand context.

7. Do humanoid robots need strict regulation?

Absolutely. Governments and tech leaders must enforce safety standards, ethical use, and accountability protocols.