AI in Finance 2025: How It Is Changing Jobs

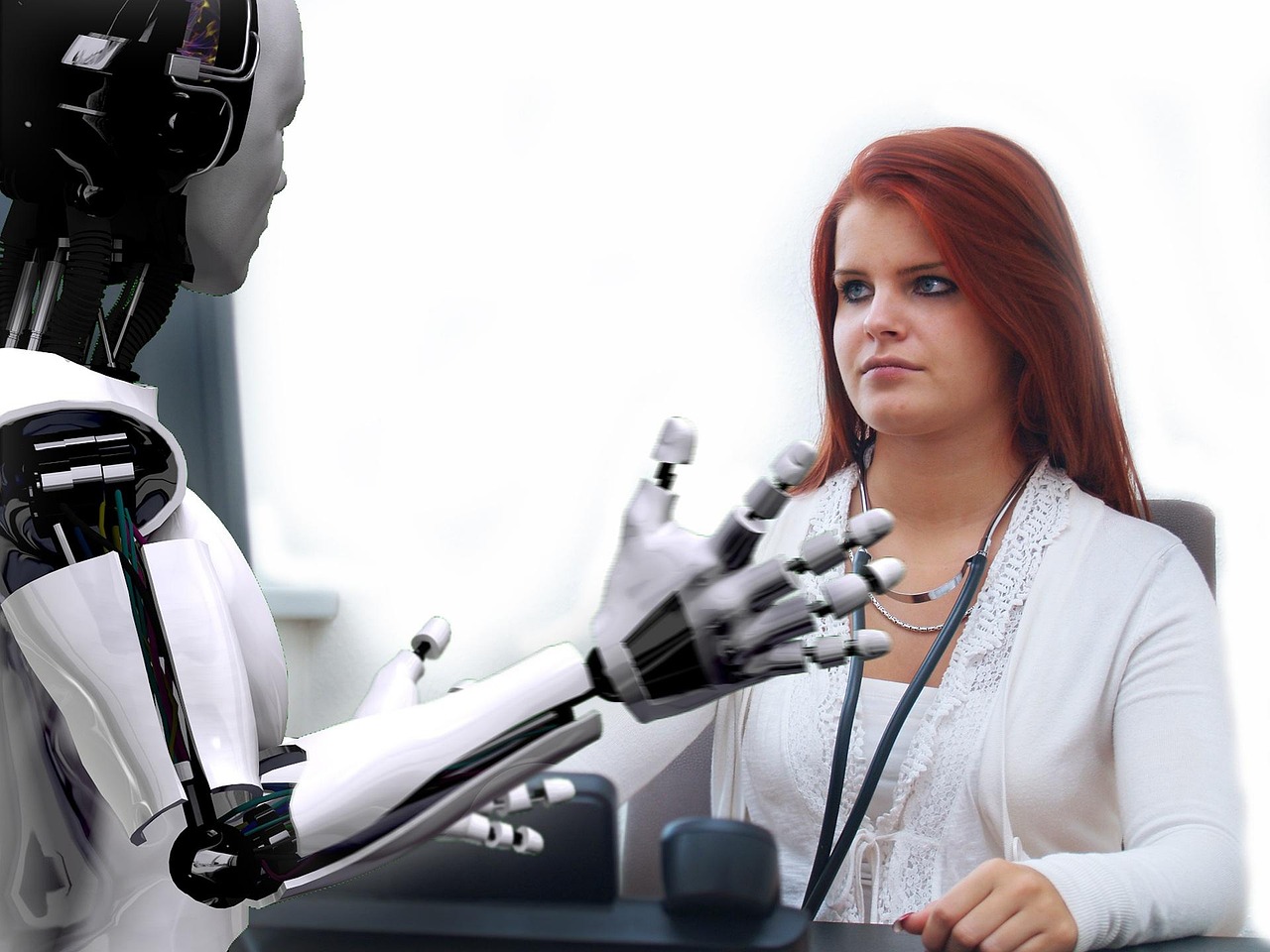

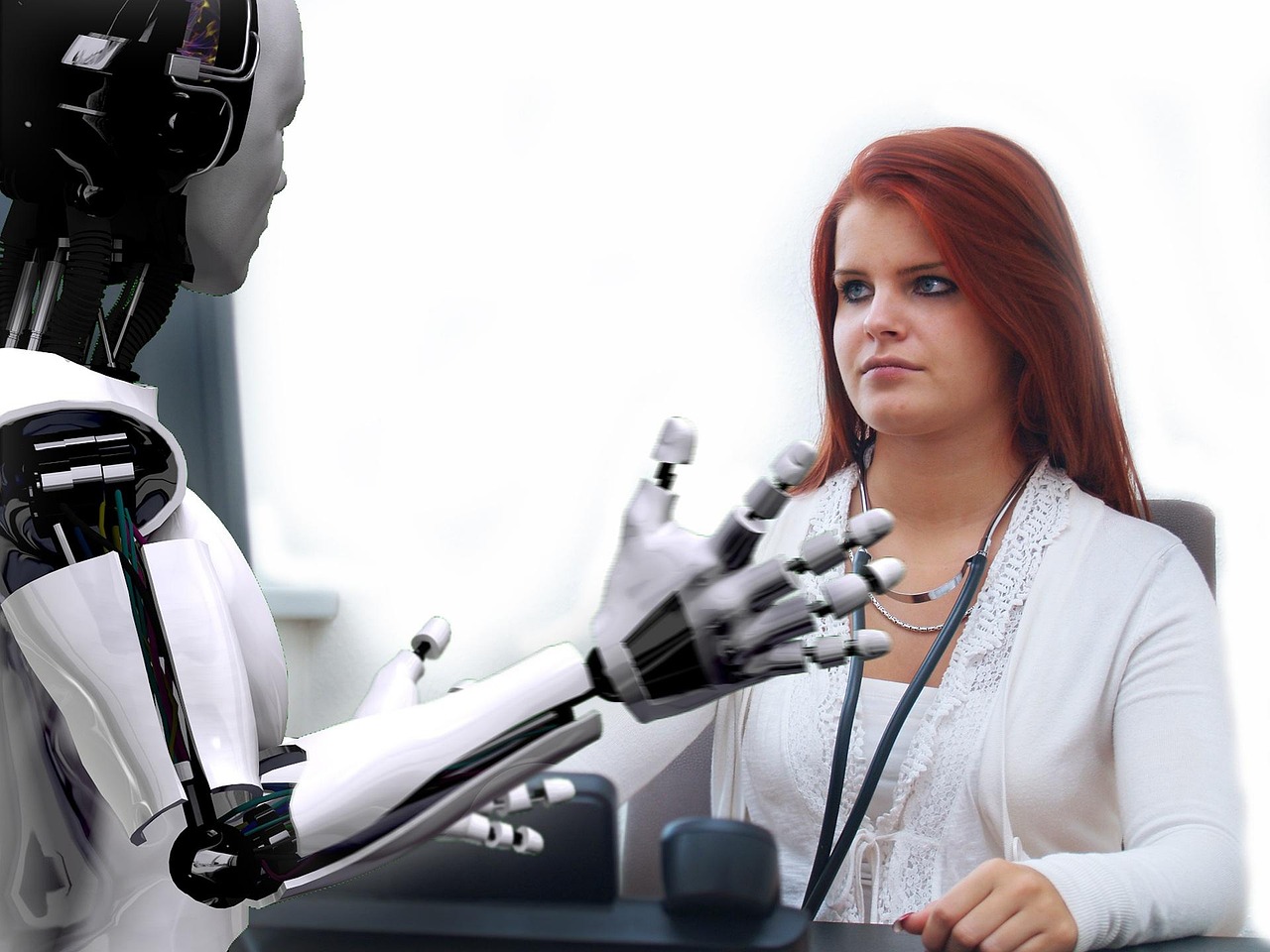

Introduction

AI in Finance 2025 is reshaping the financial industry, driving automation, and enhancing decision-making.

Banks, investors, and financial analysts are leveraging AI-powered tools to improve efficiency, security, and profitability.

From algorithmic trading

to fraud detection

and customer service automation,

AI is revolutionizing financial operations.

How AI in Finance 2025 is Changing the Financial Landscape

The financial sector is rapidly evolving with AI-driven solutions, optimizing processes, improving security, and enhancing customer experiences.

AI in Finance for Banking and Transactions

Financial institutions are implementing AI to automate banking operations, detect fraudulent transactions, and enhance cybersecurity.

AI in Finance 2025: Investment Strategies and Trading

AI-driven algorithms are reshaping investment strategies, allowing for data-driven decision-making and predictive analytics.

AI-Powered Risk Management in Finance

Advanced AI models assess financial risks, offering real-time solutions to mitigate potential losses and enhance stability.

AI in Finance 2025: The Future of Fintech

Fintech startups are leveraging AI for personalized financial services, digital lending, and automated advisory systems.

How AI in Finance is Improving Customer Experience

AI-powered chatbots and virtual assistants are enhancing customer support, offering quick and efficient financial guidance.

For more insights on business and technology, check out:

- Best Business Insurance 2025: Policies for Entrepreneurs & Startups

- Monetag vs Adsterra: Which Ad Network Pays More?

- Dark Factories: The Future of Work

This article explores the role of AI in Finance 2025 in investment strategies, banking automation, and the future of the financial sector.

The Role of AI in Finance 2025 for Banking and Transactions

AI is transforming banking operations by automating transactions, improving fraud detection, and enhancing cybersecurity.

Financial institutions are leveraging AI-powered analytics to process large datasets, detect anomalies, and prevent financial crimes.

AI-Powered Fraud Detection and Security

With increasing cyber threats, AI-driven security measures help banks detect fraudulent activities in real time.

Advanced machine learning algorithms analyze transaction patterns to identify suspicious behavior.

AI in Finance 2025: Automating Loan Approvals

AI streamlines loan processing by assessing credit scores, verifying applicant details, and reducing manual paperwork.

This improves accuracy and speeds up approvals, benefiting both banks and customers.

AI in Digital Payment Systems

AI optimizes digital payment platforms by enhancing transaction security and personalizing payment experiences.

Fintech companies use AI to enable secure and seamless payment solutions for users worldwide.

AI Chatbots for Banking Customer Service

Many banks use AI-powered chatbots to assist customers with transactions, balance inquiries, and account management.

These chatbots provide instant responses and reduce wait times.

The integration of AI in banking and finance is not just a trend but a necessity in 2025, improving security, efficiency, and customer experience.

AI in Finance 2025 for Stock Market Predictions

AI-driven analytics are revolutionizing the stock market by providing real-time data insights, pattern recognition, and predictive modeling.

Investors and traders rely on AI to make informed financial decisions and minimize risks.

AI and Algorithmic Trading

Algorithmic trading powered by AI executes trades at high speed based on market trends, reducing human error and increasing efficiency.

Hedge funds and investment firms leverage AI models to maximize profits.

AI for Investment Strategy Optimization

AI assists investors in portfolio management by analyzing market conditions, historical data, and economic indicators.

It provides risk assessments and personalized investment recommendations.

AI in Forex Trading

AI-powered forex trading platforms analyze currency fluctuations and geopolitical events to offer real-time exchange rate predictions.

This helps traders execute profitable trades with greater accuracy.

AI for Risk Management in Stock Markets

By leveraging machine learning, AI identifies potential risks in financial markets, predicting downturns before they happen.

Financial institutions use AI-driven risk models to protect investments.

AI’s impact on financial markets continues to grow, helping investors and traders navigate complex market dynamics with precision.

AI in Finance 2025 for Wealth Management and Financial Planning

AI-powered financial planning tools are reshaping how individuals and businesses manage their wealth.

From robo-advisors to AI-driven budgeting, technology is making financial management more efficient and accessible.

AI-Driven Wealth Management Solutions

AI helps financial advisors analyze client portfolios, optimize asset allocation, and provide data-driven investment strategies.

Robo-advisors use AI algorithms to offer personalized financial advice.

AI for Personal Finance and Budgeting

AI-powered apps help users track expenses, set savings goals, and manage budgets in real time.

These tools analyze spending habits and suggest ways to improve financial health.

AI in Tax Planning and Compliance

AI simplifies tax planning by automating calculations, identifying deductions, and ensuring compliance with evolving tax laws.

Businesses use AI-driven software to optimize tax strategies.

AI for Retirement and Pension Planning

AI assists individuals in forecasting retirement savings, adjusting investment portfolios, and ensuring financial stability post-retirement.

Smart algorithms calculate risks and long-term financial needs.

AI’s role in wealth management and financial planning is essential for making informed financial decisions and securing financial futures.

AI in Finance 2025 for Insurance and Risk Assessment

AI is transforming the insurance industry by improving risk assessment, automating claims processing, and enhancing fraud detection.

Insurers leverage AI-driven models to provide accurate pricing and policy recommendations.

AI-Powered Risk Assessment Models

AI analyzes vast amounts of data, including medical records, driving history, and financial reports, to assess risk levels more accurately.

This helps insurers price policies effectively and reduce losses.

According to Forbes, AI-driven risk models have significantly improved underwriting accuracy.

AI for Claims Processing and Fraud Detection

AI automates claims verification, speeding up payouts and reducing manual errors.

Machine learning models detect fraudulent claims by identifying suspicious patterns.

A report by IBM highlights how AI-powered fraud detection saves insurers billions of dollars annually.

AI in Health and Life Insurance

AI-driven underwriting assesses health risks based on medical histories and lifestyle factors.

Insurers use AI to personalize policies and optimize coverage.

Healthcare IT News reports that AI-powered tools enhance disease prediction, making coverage more tailored and proactive.

AI for Auto and Home Insurance

Telematics and AI-based data analysis help insurance companies calculate car insurance premiums based on real-time driving behavior.

Smart home AI systems also improve risk analysis for property insurance.

A McKinsey study suggests that AI adoption in auto insurance will increase profitability and policyholder satisfaction.

AI is revolutionizing insurance and risk assessment, enabling insurers to provide better customer service, reduce fraud, and optimize financial strategies.

AI in Finance 2025 for Banking and Fraud Prevention

The banking industry is leveraging AI to enhance security, automate transactions, and provide better customer experiences.

From AI-powered chatbots to real-time fraud detection, technology is redefining financial services.

AI-Powered Banking Automation

Banks are implementing AI to automate customer support, streamline loan approvals, and improve transaction processing.

According to Accenture, AI in banking reduces operational costs by up to 25% while increasing efficiency.

AI for Fraud Detection and Cybersecurity

AI-driven fraud detection systems analyze transaction patterns in real time, identifying anomalies that indicate fraudulent activities.

A report by IBM shows that AI-driven cybersecurity reduces fraud risks by up to 80%.

AI-Based Credit Scoring and Loan Approvals

AI models assess creditworthiness more accurately than traditional methods by analyzing alternative data sources like social media behavior and transaction history.

World Bank states that AI-powered credit scoring expands financial access for underbanked populations.

AI Chatbots for Personalized Banking

AI-powered virtual assistants handle customer inquiries, provide financial advice, and assist with transactions.

A Forbes article highlights how AI-driven chatbots improve customer satisfaction and operational efficiency.

With AI revolutionizing banking and fraud prevention, financial institutions can enhance security, reduce costs, and improve customer interactions.

AI in Finance 2025 for Investment and Wealth Management

AI is transforming investment strategies by analyzing vast amounts of data, predicting market trends, and automating portfolio management.

Financial advisors and institutions use AI-driven insights to optimize wealth growth.

AI for Stock Market Predictions

Machine learning algorithms analyze historical data and real-time market movements to predict stock price fluctuations.

A CNBC report states that hedge funds using AI outperform traditional funds by 15% annually.

AI-Driven Wealth Management

AI-powered financial planning tools help individuals manage their investments efficiently.

Bloomberg reports that AI-driven robo-advisors manage over $3 trillion in assets globally.

AI and Cryptocurrency Trading

AI analyzes blockchain data and market sentiment to execute high-frequency cryptocurrency trades.

CoinDesk highlights that AI-powered crypto trading bots increase trade accuracy by 30%.

AI in Hedge Funds and Asset Management

Leading hedge funds use AI to detect market patterns and optimize investment decisions.

Reuters reveals that AI-driven funds are consistently beating market benchmarks.

With AI revolutionizing investment and wealth management, investors can leverage data-driven insights for smarter financial decisions.

The Future of AI in Finance 2025: Trends and Predictions

As AI continues to evolve, its impact on finance is set to grow even further. Emerging trends indicate that AI will drive greater automation, security, and personalization in financial services.

AI-Powered Fintech Innovations

Fintech startups are leveraging AI to disrupt traditional banking models, offering smart financial solutions tailored to user behavior.

Forbes reports that AI-driven fintech firms are expected to grow by 40% in 2025.

AI in Decentralized Finance (DeFi)

AI is enhancing DeFi by improving risk assessment, liquidity management, and fraud prevention in blockchain-based financial ecosystems.

CoinDesk highlights that AI-powered DeFi platforms are reducing transaction risks by 50%.

AI for Enhanced Financial Security

AI-driven security solutions will play a crucial role in preventing cyber threats, ensuring safe and seamless transactions.

A study by IBM reveals that AI-based cybersecurity reduces financial fraud losses by billions annually.

AI-Driven Hyper-Personalized Financial Services

AI is enabling hyper-personalized banking experiences by analyzing user behavior and predicting financial needs.

McKinsey predicts that AI will enhance customer engagement by 60% in the next five years.

The future of AI in Finance 2025 is driven by innovation, security, and personalization, making financial services more efficient and customer-centric.

Frequently Asked Questions (FAQs) on AI in Finance 2025

How is AI used in finance in 2025?

AI is used in finance for fraud detection, investment automation, credit risk analysis, and personalized banking experiences. Machine learning models analyze vast financial data to improve decision-making.

What are the benefits of AI in finance?

AI improves efficiency, reduces human error, enhances fraud prevention, and provides real-time market analysis for better investment decisions.

Can AI replace human financial advisors?

AI enhances financial advisory services by providing data-driven insights, but human advisors still play a crucial role in strategic decision-making and personal financial planning.

What is the future of AI in finance?

The future of AI in finance includes autonomous banking, AI-driven financial security, decentralized finance (DeFi) automation, and hyper-personalized financial services.

How does AI impact cryptocurrency trading?

AI-driven bots analyze blockchain data and market trends to optimize crypto trading strategies, increasing efficiency and reducing risks in the volatile market.

How is AI transforming fintech companies?

AI enhances fintech services by enabling real-time transaction monitoring, smart lending, automated customer support, and fraud detection systems.

Conclusion: The Growing Impact of Artificial Intelligence in Financial Services

The influence of **AI-driven financial solutions** is undeniable, transforming financial services through automation, security, and personalized banking experiences. With rapid advancements in machine learning, predictive analytics, and decentralized finance (DeFi), AI is reshaping how businesses and consumers interact with financial institutions.

As Forbes highlights, AI-driven financial solutions are expected to boost industry efficiency by over 60% in the coming years. Similarly, McKinsey reports that AI adoption in banking is reducing operational costs while enhancing customer engagement.

For businesses and investors, staying ahead means leveraging AI-powered tools to optimize decision-making, improve risk assessment, and enhance security. Whether in fintech innovations, crypto market automation, or banking security enhancements, artificial intelligence continues to drive innovation and efficiency.

Explore more insights on business strategies and emerging technology trends for the latest developments shaping the future of finance.