Mobile Banking Solution: 7 Powerful Apps Revolutionizing Finance in 2025

Banking Solution: 7 Powerful Apps Revolutionizing Finance in 2025

Introduction

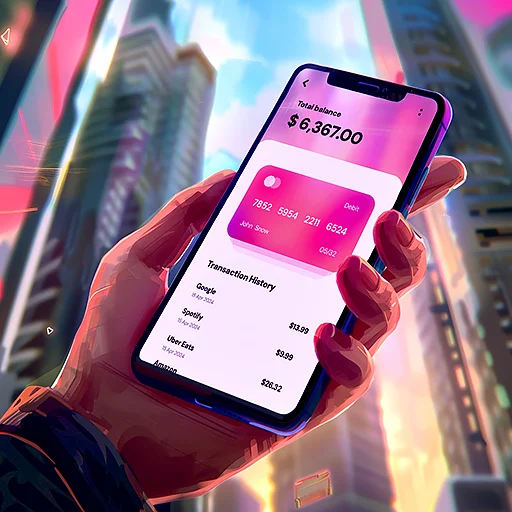

Mobile Banking Solution adoption is exploding across the U.S. in 2025. With nearly every American owning a smartphone, managing money is now simpler, faster, and more secure.

Thanks to the advancement of digital banking services, users can send money, pay bills, and monitor investments—all without stepping into a bank.

Behind these services are powerful fintech mobile platforms enabling real-time transactions and security enhancements.

In this guide, we break down the best mobile payment apps, their security features, and the role of secure banking apps in reshaping finance.

Table of Contents

- What is a Mobile Banking Solution?

- Why Mobile Banking is Booming in 2025

- Top 7 Mobile Banking Solutions in 2025

- Features That Define Great Mobile Payment Apps

- The Role of Fintech Mobile Platforms in the U.S.

- Are Secure Banking Apps Truly Safe?

- Mobile Banking vs Traditional Banking

- Best Practices for Safe Mobile Banking

- Future Trends in U.S. Mobile Banking

- Final Thoughts

What is a Mobile Banking Solution?

A mobile banking solution is an app or digital platform that allows users to perform banking activities using their smartphone.

Services include checking balances, transferring money, paying bills, applying for loans, and depositing checks.

Top financial institutions like Chase and Bank of America have invested heavily in mobile-first platforms to meet rising user expectations.

Modern digital banking services go beyond basic functions. They offer smart alerts, budget tools, and instant transfers—all while emphasizing safety.

Why Mobile Banking is Booming in 2025

In 2025, more Americans prefer mobile banking over visiting physical branches. Several factors fuel this trend:

- Widespread smartphone access

- Increased trust in app security

- Shift toward digital-only banks

- Cost-effective services and cashless trends

Over 78% of Americans now use mobile payment apps weekly, according to a recent report by Forbes.

Apps have evolved into full-fledged mobile banking solutions, offering everything from savings management to cryptocurrency access.

Top 7 Mobile Banking Solutions in 2025

Let’s explore the top 7 mobile banking solutions dominating the U.S. financial landscape:

Top 7 Mobile Banking Solutions in 2025

| # | Mobile Banking Solution | Key Features | Why It Stands Out |

|---|---|---|---|

| 1 | Chime | No fees, early direct deposit, automatic savings | Great for budgeting and saving with user-friendly app |

| 2 | Capital One Mobile | Credit monitoring, mobile check deposit, real-time alerts | Combines banking with credit insights |

| 3 | SoFi | Loans, investing, banking, high-yield savings | All-in-one financial platform for millennials |

| 4 | Ally Bank | 24/7 customer support, high-interest savings accounts | Pioneer of online-only banking with strong support |

| 5 | Discover Mobile | Excellent customer service, cashback rewards | Popular for rewards and reliable banking features |

| 6 | Cash App | Peer-to-peer transfers, banking, investing | Popular for ease of money transfer and investing |

| 7 | Revolut | Global payments, crypto, multi-currency wallets | Innovative fintech expanding rapidly in the U.S. |

Detailed Overview of Each Mobile Banking Solution

1. Chime

Chime is a no-fee neobank that has revolutionized banking for many Americans by eliminating traditional banking fees.

It offers early direct deposit, allowing users to access their paycheck up to two days early.

The app features automatic savings, helping users build emergency funds effortlessly.

Its simple and smooth user interface makes budgeting easy, especially for younger users or those new to digital banking.

2. Capital One Mobile

Capital One Mobile combines traditional banking services with modern digital features.

Beyond mobile check deposits and real-time transaction alerts, it offers credit monitoring tools that help users keep track of their credit health.

This integration makes it ideal for those looking to improve their credit scores while managing daily finances on one platform.

The clean design and seamless navigation enhance the overall banking experience.

3. SoFi

SoFi stands out as a hybrid financial platform offering loans, investing, and banking services in one place.

It provides high-yield savings accounts, making it attractive for millennials and younger professionals seeking to grow their wealth while managing expenses.

SoFi’s integrated approach allows users to borrow, save, and invest without juggling multiple accounts, supported by an easy-to-use mobile app.

4. Ally Bank

Ally Bank is one of the pioneers of online-only banking.

It offers high-interest savings accounts, no monthly maintenance fees, and 24/7 customer support via phone and chat.

Known for its reliable digital platform, Ally appeals to customers who prefer managing their finances without ever visiting a physical branch.

Its focus on customer service and competitive rates keeps it a top choice among digital banking solutions.

5. Discover Mobile

Discover Mobile offers a robust mobile experience known for exceptional customer service and valuable cashback rewards.

The app supports features like mobile check deposit, bill pay, and budgeting tools.

Its strong reputation and reliable banking infrastructure attract customers who want both rewards and a secure banking environment, making it a trustworthy option.

6. Cash App

Originally popular for peer-to-peer money transfers, Cash App has expanded its services to include banking and investment options.

Users can send and receive money instantly, invest in stocks, and even buy Bitcoin through the app.

Its easy-to-use interface and versatile features make it a popular choice, especially among younger users who want quick financial services on the go.

7. Revolut

Revolut is an innovative fintech company offering global payments, cryptocurrency trading, and multi-currency wallets.

Its expansion into the U.S. market in 2025 brings cutting-edge financial tools to American users.

Revolut’s features appeal to travelers, expatriates, and tech-savvy users who need flexible, borderless banking options combined with advanced security.

Why These Apps Are Leading Secure Banking Apps

- User Experience (UX): Each app offers intuitive designs that make banking simple and fast.

- Security: Enhanced fraud detection systems and biometric authentication protect user accounts.

- Speed: Real-time transaction updates and quick processing improve customer satisfaction.

- Versatility: Features range from savings and payments to investments and loans.

Real-Life Case Study: How Chime Transformed Banking for Sarah

Sarah, a 28-year-old freelancer in New York, struggled with traditional banks due to fees and limited access.

After switching to Chime, she experienced early access to her paycheck two days before payday, easing cash flow problems.

She also benefited from automatic savings that helped her build an emergency fund without extra effort.

There were no monthly or overdraft fees, saving her hundreds of dollars annually.

Mobile alerts kept her informed about spending habits and balances.

This switch empowered Sarah to manage her finances effortlessly through her phone, demonstrating how mobile banking solutions are improving lives across the U.S.

Features That Define Great Mobile Payment Apps

The best mobile payment apps have certain must-have features that separate them from the rest.

Speed is essential. Whether you’re splitting dinner or paying rent, transactions must be instant and glitch-free.

Security is non-negotiable. Apps must offer biometric login, two-factor authentication, and real-time fraud alerts.

All-in-one functionality matters. Apps that include budgeting, savings goals, credit monitoring, and investment access offer better value.

Cross-platform support ensures that whether you’re using iOS or Android, the app works flawlessly.

Examples like Zelle and Venmo continue to dominate because they combine speed with trusted bank integration.

The Role of Fintech Mobile Platforms in the U.S.

Fintech mobile platforms act as the technology backbone for many banking apps.

They power APIs, automate transfers, verify user identities, and enable open banking.

Plaid, for example, connects over 11,000 financial institutions, allowing users to link multiple accounts securely.

Stripe and Square have revolutionized merchant banking and digital wallets, enabling instant settlements.

These platforms don’t just support banks—they empower small businesses, freelancers, and underbanked communities to join the digital economy.

Here we show how the U.S. fintech scene is influencing global innovation.

Are Secure Banking Apps Truly Safe?

Yes, secure banking apps are safer than ever, thanks to cutting-edge tech and strict compliance.

Biometric logins prevent unauthorized access. End-to-end encryption ensures your data stays private.

Reputable apps also include real-time fraud monitoring and immediate freeze options.

However, users must practice caution:

- Avoid public Wi-Fi

- Enable app alerts

- Always update the app to the latest version

FDIC advises consumers to verify apps and read privacy policies before use.

Mobile Banking vs Traditional Banking

Mobile banking eliminates many of the hassles of traditional banks.

You don’t need to wait in lines, work within branch hours, or carry cash.

Mobile banking solutions also offer better insights. You can monitor spending in real time, set alerts, and plan budgets.

However, traditional banks still have advantages in offering complex services like business loans or estate planning.

Many users now choose hybrid banking—using mobile for daily finance and branches for long-term needs.

Best Practices for Safe Mobile Banking

To ensure your financial safety while using mobile banking:

- Use strong passwords and enable 2FA

- Always download apps from official stores

- Avoid storing passwords on your device

- Monitor account activity frequently

- Lock your phone when not in use

Some apps even offer virtual cards for safer online transactions.

Platforms like NerdWallet provide updated mobile banking safety tips.

Future Trends in U.S. Mobile Banking

Here are major trends shaping mobile banking in the U.S.:

AI-Powered Banking: Chatbots and AI are personalizing financial advice.

Voice-Activated Transfers: Voice assistants now enable hands-free banking.

Crypto Banking: Integration with digital assets continues to grow.

Open Banking APIs: U.S. banks are adopting more flexible integration with third-party apps.

Sustainability Tools: Apps now track eco-impact of purchases.

Explore more trends via Craftdas Fintech Trends.

Final Thoughts

In 2025, choosing the right mobile banking solution is essential to managing your finances effectively.

Whether you use mobile payment apps, trust secure banking apps, or explore advanced digital banking services, the tools at your fingertips are smarter than ever.

As fintech mobile platforms continue evolving, expect faster, safer, and more personalized banking experiences.

Ready to switch to smarter money management? Start with any of the top apps listed above and take control of your finances—securely, digitally, and easily.