Table of Contents

- 1 Top 5 Safe Online Loan Lenders: Trusted, Secure & Reputable Digital Loan Platforms for Fast Approval

- 2 Table of Contents

- 3

- 4 What Are Safe Online Loan Lenders?

- 5 How to Identify Reputable Online Lending Platforms

- 6 Benefits of Using Secure Internet Lenders

- 7 Top 5 Safe Online Loan Lenders in 2025

- 8 Key Features to Look For in Trusted Online Loan Companies

- 9 Warning Signs of Unsafe Loan Platforms

- 10 Real Customer Experiences with Digital Loan Providers

- 11 How to Apply Safely for Online Loans

- 12 External Resources and Consumer Protection

- 13 Conclusion

Top 5 Safe Online Loan Lenders: Trusted, Secure & Reputable Digital Loan Platforms for Fast Approval

In the digital age, borrowing money has never been easier—but finding safe online loan lenders is more important than ever. With financial scams on the rise, it’s crucial to identify trusted online loan companies that offer not just speed but also transparency, security, and reliability.

Whether you’re facing a medical emergency, consolidating debt, or just need extra cash, this guide explores the best digital loan providers that prioritize your data and financial safety.

Table of Contents

- What Are Safe Online Loan Lenders?

- How to Identify Reputable Online Lending Platforms

- Benefits of Using Secure Internet Lenders

- Top 5 Safe Online Loan Lenders in 2025

- Key Features to Look For in Trusted Online Loan Companies

- Warning Signs of Unsafe Loan Platforms

- Real Customer Experiences with Digital Loan Providers

- How to Apply Safely for Online Loans

- External Resources and Consumer Protection

- Conclusion

What Are Safe Online Loan Lenders?

Safe online loan lenders are legitimate financial service providers that operate through web-based platforms and comply with state or federal lending regulations. These lenders use advanced encryption technologies, perform identity verification, and disclose all terms transparently before approval.

Unlike traditional brick-and-mortar banks, these digital platforms offer instant or same-day loan access, often with automated underwriting and decision-making. Their main goal is to provide convenience without compromising data privacy or regulatory standards.

Most safe online loan lenders are registered with government agencies, follow fair lending laws, and disclose key terms like APR (Annual Percentage Rate), fees, and payment schedules. This helps consumers make informed borrowing decisions without falling victim to hidden charges or predatory lending practices.

To ensure safety, these platforms implement 256-bit SSL encryption, two-factor authentication, and secure cloud storage to safeguard sensitive data such as Social Security numbers, bank details, and credit reports. They often partner with credit bureaus and financial institutions to enhance identity verification and fraud prevention.

How to Identify Reputable Online Lending Platforms

Spotting reputable online lending platforms can be tricky, especially when scam websites mimic legit financial institutions. However, several indicators can help you differentiate a secure lender from a fake one:

- Licensing & Regulation: Ensure the lender is licensed to operate in your state or region. Use the NMLS Consumer Access database to verify credentials.

- Website Security: Look for “https://” in the URL and a padlock icon, which means the site uses SSL encryption for safe browsing and data entry.

- Transparent Lending Terms: Reputable lenders disclose interest rates, APR, loan duration, origination fees, and penalties up front. No surprises after signing.

- Online Reputation: Check third-party review platforms like Trustpilot and Better Business Bureau (BBB) for consistent ratings, real customer feedback, and complaint resolution history.

- No Upfront Payments: Legitimate lenders never ask for upfront fees, prepaid cards, or wire transfers to process your application.

- Customer Support & Accessibility: A reliable lender will have responsive customer service, clear contact information, and FAQ sections for borrower education.

For further verification, consult the Consumer Financial Protection Bureau (CFPB), which tracks complaints, fraud alerts, and enforcement actions against dubious lenders. The CFPB also provides useful guides to help borrowers compare lenders based on their needs and credit profile.

Related Posts:

- Top 10 Shocking PPP Loan Frauds List That Exposed Massive Scams

- PPP Loan Fraud — 2025: Shocking Cases, Penalties & How to Avoid Jail Time

- Top 10 Smart Loan Fraud Protection Tips to Safeguard Your Finances Today

- Is Loan Legitimate? Discover 5 Powerful Warning Signs of Dangerous Scams

- Top 5 Safe Online Loan Lenders: Trusted, Secure & Reputable Digital Loan Platforms for Fast Approval

Benefits of Using Secure Internet Lenders

Choosing secure internet lenders comes with a wide range of financial and practical benefits. These lenders combine regulatory compliance with tech-driven efficiency, making online borrowing not only faster but also safer and more personalized.

1. Faster Approvals

Secure internet lenders often use AI-powered underwriting systems to assess loan applications in real time. This allows many borrowers to get approval within minutes and receive funds within 24 hours—without needing to visit a physical branch.

2. Flexible Terms

Most safe online loan lenders offer customizable repayment plans, letting you choose durations that suit your monthly income and cash flow. Some platforms even allow early repayment with zero penalties, which helps reduce long-term interest costs.

3. Low Credit Requirements

Unlike traditional banks, many reputable online lending platforms consider more than just your credit score. They assess your employment history, income streams, and recent financial activity to approve loans—even for those with poor or limited credit history.

4. Upfront Transparency

Trusted online loan companies clearly outline all terms before you sign: interest rate, APR, repayment schedule, late fees, and any service charges. This level of transparency protects you from surprise deductions or hidden costs down the line.

5. 100% Digital Application

The entire loan process—application, verification, approval, and funding—is conducted digitally. No physical paperwork, long queues, or in-person meetings are required. Most lenders offer secure dashboards and mobile apps to track your loan in real time.

To explore options from licensed and secure platforms, visit resources like NerdWallet or Credit Karma, which compare loan offers from trusted internet lenders based on your credit profile and borrowing needs.

Top 5 Safe Online Loan Lenders in 2025

1. SoFi (Social Finance)

- Best for: Low-interest personal loans

- SSL Protected: Yes

- APR: From 8.99%

- Loan Amount: $5,000 – $100,000

- Approval Time: Same day

2. Upstart

- Best for: Borrowers with fair credit

- APR: From 6.5%

- Loan Amount: $1,000 – $50,000

- Approval Time: 24 hours

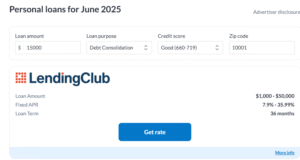

3. LendingClub

- Best for: Debt consolidation

- APR: From 8.3%

- Loan Amount: $1,000 – $40,000

- Approval Time: 1–3 days

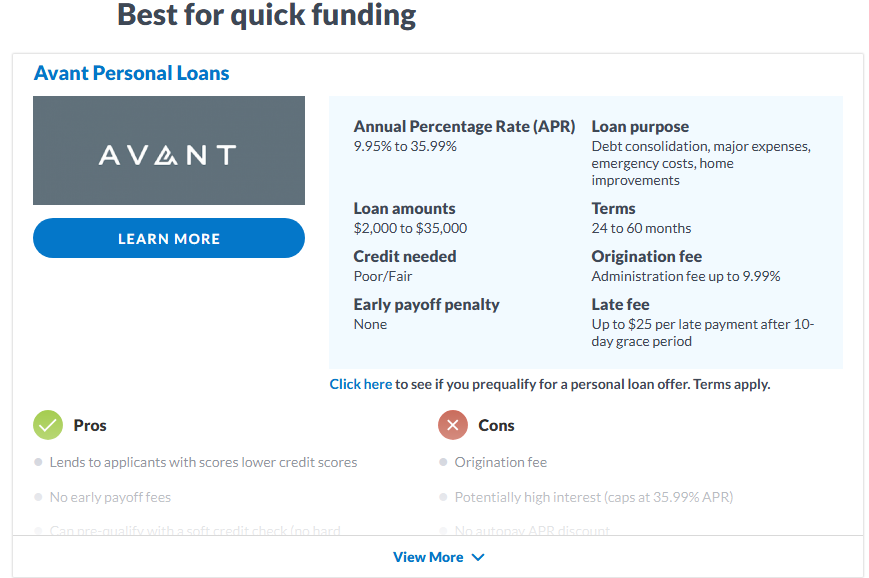

4. Avant

- Best for: Quick funding, fair credit

- APR: From 9.95%

- Loan Amount: $2,000 – $35,000

- Approval Time: Next day

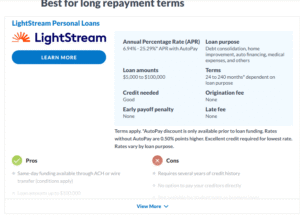

5. LightStream (by Truist)

- Best for: Large personal loans

- APR: From 7.49%

- Loan Amount: $5,000 – $100,000

- Approval Time: Same day

Key Features to Look For in Trusted Online Loan Companies

| Feature | Description |

|---|---|

| Encryption | 256-bit SSL or higher security |

| Clear Terms | No hidden or confusing language |

| Compliance | Registered with CFPB or FDIC |

| Support | Available human support channels |

| Flexible Payments | Grace periods or early payment allowed |

Warning Signs of Unsafe Loan Platforms

- No SSL (padlock icon missing)

- Unsolicited texts or calls

- Requests for upfront fees

- No customer reviews or contact info

- Vague or false promises

Real Customer Experiences with Digital Loan Providers

Firsthand reviews offer valuable insight into the reliability of digital loan providers. Here are a few authentic customer experiences shared by users across the United States:

“I used Upstart for emergency funds. Got approval in less than 24 hours.” – Tracy W., New York

“SoFi’s no-fee process made it super easy. Totally recommend it.” – Malcolm T., Florida

“LendingClub helped me cut my debt interest rate in half.” – Amanda R., Texas

These testimonials reflect the convenience, transparency, and support that secure internet lenders offer. You can explore more reviews on verified platforms like Trustpilot or the Better Business Bureau (BBB).

How to Apply Safely for Online Loans

Applying with reputable online lending platforms doesn’t have to be risky. Follow these essential steps to ensure safe borrowing:

- Check your credit score using free tools like Credit Karma.

- Compare multiple lenders using platforms like NerdWallet to find the most suitable rates and terms.

- Use pre-qualification tools to check eligibility without hurting your credit with hard inquiries.

- Securely upload documents through the lender’s official website—always verify the URL for security (https://).

- Read the fine print—including fees, APR, penalties, and auto-payment terms—before submitting your application.

Taking a few minutes to vet and cross-check platforms can save you from scams and financial regret later on.

External Resources and Consumer Protection

If you’re new to online borrowing or unsure about a lender’s legitimacy, these trusted institutions offer guides, education, and complaint resolution channels:

- Federal Trade Commission (FTC) – Offers consumer alerts on scams and fraud prevention tips.

- Consumer Financial Protection Bureau (CFPB) – Tracks complaints and enforces financial laws.

- Better Business Bureau (BBB) – Lists business ratings, user complaints, and fraud history.

- National Foundation for Credit Counseling (NFCC) – Connects consumers with certified financial counselors.

Bookmark these resources to validate any unfamiliar lenders or to file complaints if you suspect predatory behavior.

Conclusion

In 2025, accessing funds from safe online loan lenders is more convenient than ever, but only when done cautiously. Whether you’re applying through SoFi, LightStream, or Upstart, make sure the platform is licensed, secure, and highly rated.

Use comparison tools, read user reviews, and avoid platforms that ask for fees upfront or skip credit checks entirely. Choosing trusted online loan companies not only ensures quick approvals but also protects your credit health and digital security in the long run.